Ground Floor, 1919 Malvern Road,

Malvern East,

VIC 3145 Australia.

As the digital era reshapes banking, more Australians are turning towards digital-first financial institutions. Staying ahead in this digital landscape is essential, and we're excited to announce that Northern Inland Credit Union (Northern Inland) has made a colossal leap toward digital transformation with its recent investment in its core banking digital infrastructure upgrade to Ultracs 5.1.

This upgrade lays a solid foundation that empowers Northern Inland to seamlessly embrace upcoming products and features from the Ultracs Ecosystem. It promises members improved experiences, and simplified interactions and ultimately makes Northern Inland even easier to deal with.

"Northern Inland Credit Union’s core banking upgrade to Ultracs 5.1 went very smoothly. The project ran ahead of schedule, on budget, and without any problems." Derek McIntyre, CEO of Northern Inland Credit Union.

Northern Inland Credit Union (Northern Inland) is a member-owned financial institution, focused on finding smarter ways for their members to manage money. With over 50 years of experience in providing financial services, Northern Inland is deeply rooted in its communities. Based in Tamworth, the financial institution has branches in Gunnedah and Narrabri and serves around 16,000 members.

Since the 1980s, Northern Inland has been committed to delivering financial services that suit its local market, families, and community. This means that they are always on the lookout for fresh and innovative products and services. Since 2006, the partnership between Northern Inland and Ultradata has been instrumental in achieving this goal.

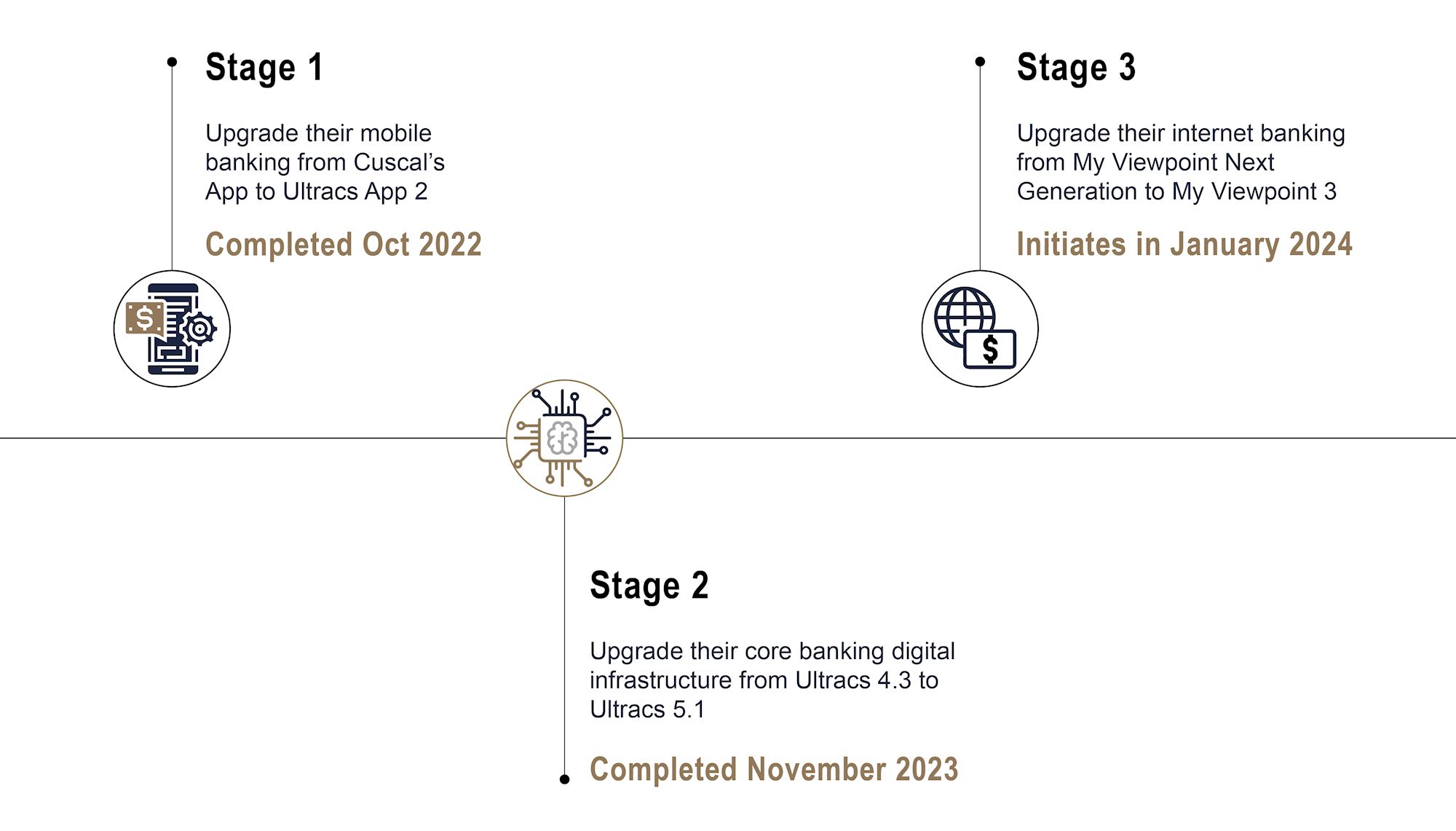

A digital suite upgrade would generally begin with the upgrade of the foundational core banking infrastructure. This project was a little different from this way of planning as Northern Inland urgently needed to upgrade their mobile banking app and migrate its Cuscal App to Ultracs App 2 which was coming to end-of-life.

The mobile banking app migration took place in record time, only taking two months to be complete to beat Northern Inland’s deadline.

The Ultracs App 2 Release 3 is an agile and smart digital mobile banking app that has the capacity to integrate new software solutions as needed.

In the case of Northern Inland, the financial institution invested in optional software modules to give their members access to functionality including digital wallets, self-service banking options, card management, financial budgeting functionality (How I Spend), and much, much more.

"The How I Spend software is a really convenient benefit for members as it allows them to see how they are spending their money, when they are spending their money and help them with their personal finance management." Derek McIntyre, CEO of Northern Inland Credit Union.

One of the key objectives for Northern Inland Credit Union is to make it even easier for our members to deal with us. Derek McIntyre, CEO of Northern Inland Credit Union.

Northern Inland's decision to upgrade its core banking infrastructure to Ultracs 5.1 was driven by a number of factors;

"One of the standout advantages of Ultradata's products is their forward-looking approach. Ultradata anticipates regulatory requirements, ensuring that its solutions are not just compliant but also operational well in advance of mandatory implementation. This proactive stance is particularly crucial in the highly regulated banking industry." Derek McIntyre, CEO of Northern Inland Credit Union.

The Ultracs Ecosystem prioritises customer needs, seamlessly integrating with all business processes and channels, enabling Northern Inland to stay agile and competitive. It ensures a smooth experience for Northern Inland members, facilitating product origination, onboarding, and digital interaction.

Ultracs 5.1 is a robust and reliable platform that operates with minimal downtime, ensuring uninterrupted service and instilling peace of mind. The core banking technology has accurate transaction processing, that reinforces trust in Northern Inland’s financial operations.

The Ultracs 5.1 upgrade was essential for Northern Inland to upgrade its Internet banking platform from My Viewpoint Next Generation to My Viewpoint 3 Release 4.

The Internet banking upgrade is scheduled to be initiated in January 2024. My Viewpoint 3 ensures seamless integration and a consistent user experience across various devices, including desktops, tablets, and smartphones. Members will be able to access their accounts and perform transactions effortlessly, regardless of their preferred device.

Some of the optional modules that Northern Inland has invested in to offer their members additional functionality include;

Digital Cards – This function will integrate with the card issuer allowing Northern Inland to issue digital cards straight into the wallet on their member’s phone. This will allow new members to process transactions right off the bat, while they wait for their physical card to arrive.

Self-serve Password Reset – This will enable members to reset their passwords with ease, without having to directly contact the credit union will free up resources to be able to offer an improved service to all members.

Online Identification – Will permit members to sign up online and have their ID verified without going into a physical branch.

Over the next three years, Northern Inland plan to focus on digital innovation through further automation, improved usage of CRM systems, and increased ultilisation of data for marketing and member personalisation purposes.

Automation will play an important role in streamlining operations, making members' interactions seamless and efficient.

Northern Inland wishes to expand its use of Customer Relationship Management tools to enhance member engagement. These tools will help the credit union to leverage data to deliver tailored services that cater to individual member’s needs.

A part of Northern Inland’s strategic vision is to be able to fully onboard and offboard members digitally. Streamlining these processes will not only improve members’ experience but also optimise resource allocation.

The upgrade to Ultracs 5.1 has had a profound impact on Northern Inland, delivering a range of benefits for both the organisation and its members. It empowers Northern Inland to stay competitive in the digital era, providing cutting-edge services and experiences.

From a strategic standpoint, the upgrade has enabled Northern Inland to modernise its mobile banking app, align its core banking technology to Ultradata's newer products within the Ultracs Ecosystem, and ensure a forward-looking approach to regulatory compliance.

This decision has laid the foundation for Northern Inland's digital transformation and long-term growth while providing a significantly improved member experience by introducing innovative features and functionality.

Ultradata’s strategic plan is dedicated to constant innovation and we are proud to offer one of the most advanced and complete systems in the Australian financial services software marketplace.

A significant part of our focus is sustaining the growth and long-term success of financial institutions by making reliable and trusted banking technology available to clients and their customers. Our culture and values are built on the strongest principles of working with passion, integrity, and dedication.

Ultradata congratulates Northern Inland on its successful upgrade to Ultracs 5.1. We look forward to continuing our partnership, supporting Northern Inland's mission to make banking easier for its members, and witnessing the positive impact this transformation has had and will continue to have on their community.