Ground Floor, 1919 Malvern Road,

Malvern East,

VIC 3145 Australia.

In the ever-evolving world of banking, staying at the forefront of digital transformation is crucial. We are thrilled to share the journey of The Capricornian, and their recent success in upgrading their digital banking infrastructure and branding with Ultradata's cutting-edge solutions.

Every significant transformation begins with a solid foundation, and for The Capricornian, this foundation was laid with the upgrade to Ultracs 5.1. With the core banking upgrade in place, The Capricornian was well positioned to be able to upgrade their Online Banking to My Viewpoint 3 and their banking app to Ultracs App 2.

The Capricornian's journey is not just a digital technology infrastructure upgrade but a testament to serving their community. It was a journey of progress, innovation, and commitment to the changing demands of their customers.

The Capricornian is a credit union based in Rockhampton, Queensland, who is proud to be connected to the surrounding Central Queensland communities. They have been supporting people living in the region for over 60 years and are focused on customer needs and what they are seeking; from competitive banking products and services to community investments and personalised service.

With approximately $419 million in assets and a network of eight branches, The Capricornian plays a vital role in the financial wellbeing of the region.

The Capricornian, in collaboration with Ultradata, embarked on the journey of reinventing their brand image across their digital banking platforms, with the aim of remaining relevant and positioning themselves for growth.

“The Capricornian’s existing versions of Online Banking and Cap App had been the same look, feel and functionality for nearing 8 years, which had far surpassed the rapid digital transformation of recent years. The Capricornian’s objective was to be able to offer members new and enhanced digital banking services via fresh, clean, easy to use platforms.” - Natalie Ohl, Chief Strategy Officer at The Capricornian

The digital infrastructure upgrade provided an opportunity to enhance the digital banking interfaces and showcase The Capricornian’s fresh new look branding, that had already been rolled out across other mediums.

In today's banking landscape, customer’s young and old use digital services for their banking needs, so it was important for The Capricornian that the upgraded platforms catered to a diverse audience.

The brand transformation was about crafting a user experience that resonated with the demands and expectations of the younger generations, as well educating the existing older Capricornian generations on the benefits of this change, how to embrace the change, and why.

“The branding and design elements for our Online Banking and App platforms were the first thing to be done as part of the project. Ultradata’s Digital Service team made this a quick and easy creative process for us, as they got the design brief right almost from the beginning. The Capricornian’s Marketing and Community Engagement team shared The Capricornian’s branding style guide and provided reference to The Capricornian’s newly launched website so that the branding of all Digital Platforms aligned. Ultradata’s Digital Service team then presented the Online Banking and App designs to us for approval and they nailed the colour schemes, branding and imagery and we really didn’t need to make many changes.” - Natalie Ohl, Chief Strategy Officer at The Capricornian

The Capricornian now offers a seamless banking experience for both the tech-savvy and those who prefer traditional banking methods, ensuring a smooth and inclusive upgrade experience for everyone.

“The Capricornian’s Online Banking and Cap App platforms now look clean and user friendly, with members already sharing comments about how much they love the colours scheme and the usability of the platforms.” - Natalie Ohl, Chief Strategy Officer at The Capricornian

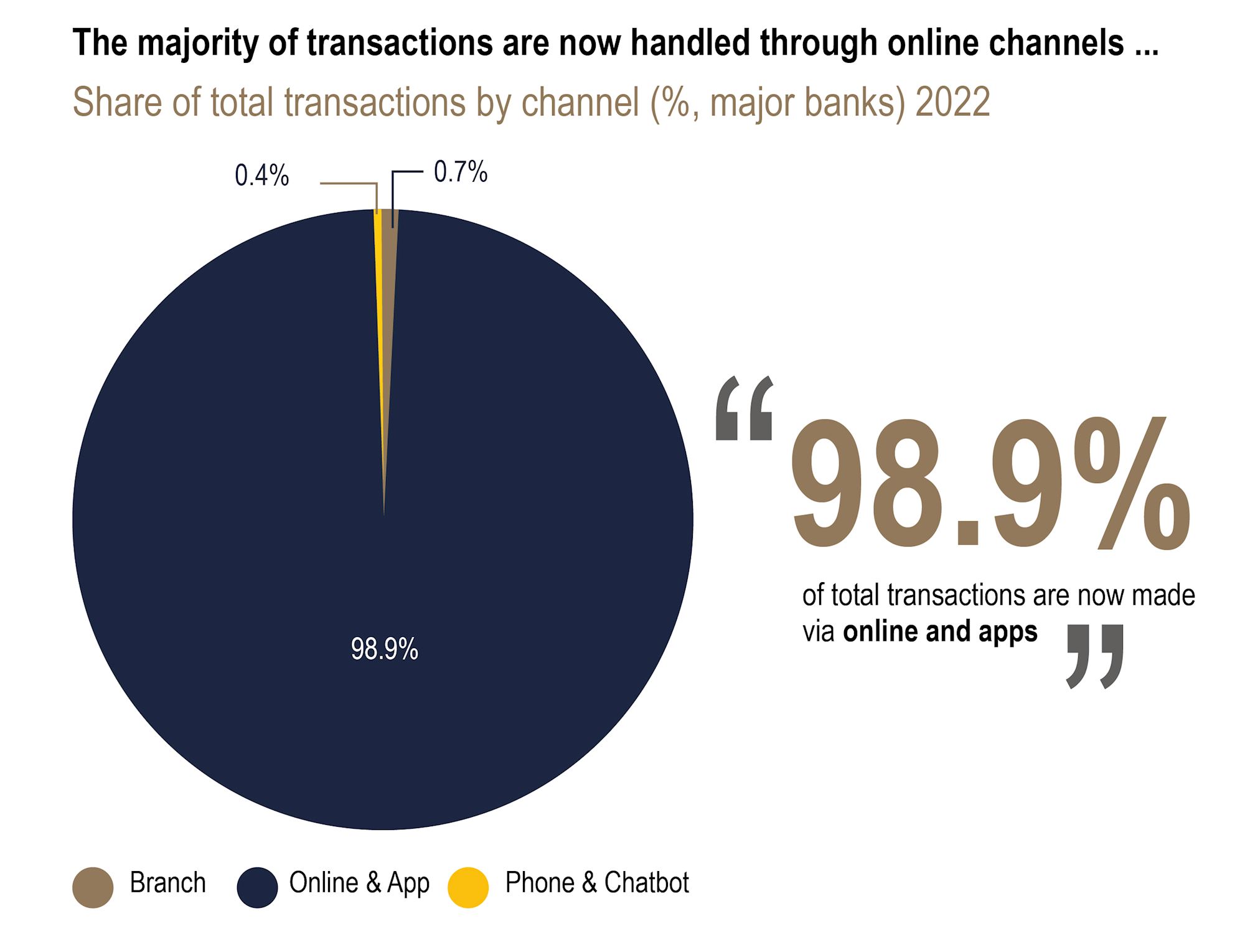

The Australian Banking Association, in partnership with Accenture, has published the Bank On It – Customer Trends 2023 report, which showed that 98.9% of customer interactions were now taking place via apps or online, and cash is being used for just 13% of payments down from 70% in 2007.

The upgrade process involved The Capricornian upgrading from My Viewpoint Next Gen to My Viewpoint 3 release 4, and from Ultracs App 1 to Ultracs App 2 release 3, and positions The Capricornian at the forefront of the modern banking landscape, ready to serve its members with innovative, responsive, and user-friendly platforms.

The integration of a new content management system (CMS) within Ultracs App 2 has also helped The Capricornian gain control over its brand and its messaging, and are now able to easily modify content on demand, customise login/logout screens, and provide spotlights for new products, and much, much more.

“Having access to the new CMS that is behind the App 2, has given us greater control over The Capricornian’s brand and the products and messaging we want to share with members. We couldn’t do this easily with the previous version of the app” - Natalie Ohl, Chief Strategy Officer at The Capricornian

The benefits of Ultradata's solutions extend beyond branding. My Viewpoint 3 and Ultracs App 2 improve the user experience and streamlines banking operations, making it a cost effective and relationship driven solution.

My Viewpoint 3 ensures seamless integration and a consistent user experience across various devices, such as desktops, tablets, and smartphones, and members can access their accounts and perform transactions effortlessly, regardless of their preferred device.

Further optional software module investments made by The Capricornian;

My Viewpoint 3 Online pin change: The upgraded Online Banking platform pin change feature provides the convenience to manage pin change anytime, from anywhere.

Ultracs App 2 Customer managed password reset: The upgraded banking app platform allows users to reset their own password that adds customer convenience and enhances customer trust in the organisations ability to keep their accounts secure.

Under consideration;

My Viewpoint 3 Secure messaging with attachments: The potential for secure messaging with attachments is being considered. This feature will allow members to communicate securely with their respective banks, share essential documents, and exchange information within a protected environment.

Extensive testing was conducted prior to the go live launch with Ultradata’s team evaluating every step of what they were delivering to ensure that it didn’t have any impact on The Capricornian’s existing products. This required a vast amount of coordination between the two organisations and by using The Capricornian staff as the facilitators of the soft-launch, provided the opportunity for valuable feedback to fine-tune the user experience in safe constraints protecting the brand.

This approach also prepared staff to be able to assist members with any questions post Go Live date, as they were all familiar with the new platforms.

The Capricornian remains a bright, convenient, and a community driven credit union.

Ultradata’s and The Capricornian’s shared expertise and synergy ensured a successful migration, and as a result were able to deliver highly responsive platforms to their members.

As their longest serving technology partner both companies were able to witness the evolution of The Capricornian digital banking infrastructure transformation;

It's been a journey marked by collaboration and a shared vision of progress, with the result being vibrant and modern digital banking platforms.

Congratulations to The Capricornian on this remarkable upgrade achievement.